Get in touch

- Office # 304 Emirates Islamic Bank Building, 90 Baniyas Road Deira, P.O Box 41148 Dubai-UAE.

- info@wallsofttech.com

- +971-4-2231120

- Monday to Friday: 10am to 7pm

eTransfer

-

WallSoft - Currency Exchange Software Solutions > eTransfer

eTransfer

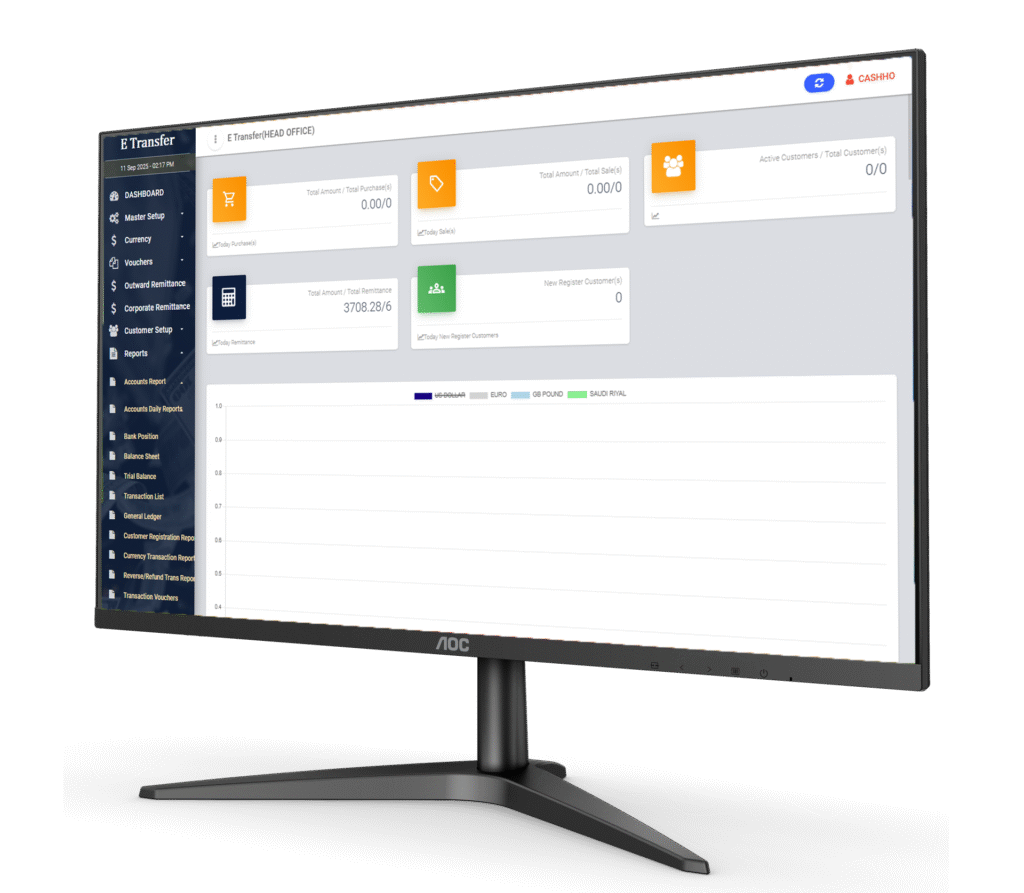

In today's fast-paced business landscape, eTransfer emerges as the ultimate solution for swift and secure remittance transfers, regardless of their size.

eTransfer

eTransfer

Transaction Monitoring

Offering essential features such as real-time updates, meticulous tracking, bulk transfer capabili- ties, and configurable amount limitations, eTransfer has rapidly solidified its position as the premier software application for electronic remittance transfers worldwide. Remarkably, it accomplishes these transfers within a mere 5–10-minute pro- cess.

Transaction Monitoring

- Monitors all inward and outward remittance transactions.

- Allows viewing transactions at any stage or level.

- Tracks transaction delays.

System Capabilities

Transaction Monitoring

- Monitors all inward and outward remittance transactions.

- Allows viewing transactions at any stage or level.

- Tracks transaction delays.

Customer Information Validation:

- Validates customer information using name Scree and Risk Mangament

- Alerts about suspected persons.

- Customer Documents Expiry Validation as Country Law

Transaction Limits:

- Assigns customer transaction limits for specific periods.

Comprehensive Reporting:

- Provides reconciliation reports, including daily transaction volume and amount.

- Customizable reports available.

Audit Trail:

- Maintains an audit trail for transaction history, including input, updates, and authorizations.

Operator

Makes outward and inward transactions.

Administrator

Authorizes all outward transactions made by operators.

Company Administrator

Authorizes outward remittances by agents. Updates agent’s funding.

Call Centre User

Views inward remittances for specific cities to contact customers.

Server User

Creates new agents and users. Updates daily currency rates. Updates company funding..

Server Administrator

Creates new companies and branches.

Authorized Money Transfer Channels

Uses the software to allow agents/branches to receive money globally. .

Multi-Branch and Franchisee Management

Seamlessly manage multiple branches, franchisees, and agents with ease.

Effortless Customer Onboarding

Simplify customer onboarding with built-in compliance and KYC (Know Your Customer) capabilities.

Streamlined Cashier Operations

nhance branch efficiency with sup- port for multiple cashier one window operations.

Vault Management

Efficiently manage vault operations at all branches.

Central Bank Compliance

Automatically generate Central Bank-re- quired reports and data formats for regulatory compliance.

Integration Possibilities

Seamlessly integrate with other money transfer systems to expand your business capabilities.

Anti-Money Laundering Amendments

Stay compliant with anti-mon- ey laundering regulations through enabled amendments.

Online Customer Compliance

Streamline customer compliance pro- cesses with online capabilities.